After Procter & Gamble (P&G) launched the Olay Super Serum in the United States in 2023, the product shot to pole position among serums there. A bottle of this, combining five benefits of serums into one potion, was being sold every minute.

It was flying off the shelves, but what was less well-known about it was that it was a product of P&G’s Singapore Innovation Centre (SgIC) in Biopolis, Singapore’s research and development (R&D) hub for biomedical science.

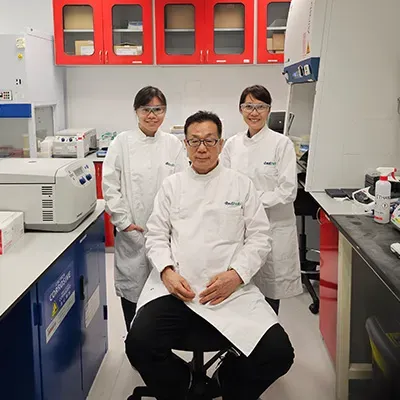

The SgIC is the consumer goods giant’s largest beauty innovation hub in Asia. The 32,000-square-metre facility handles consumer understanding, formulation, advanced analytical capabilities, data science and modelling, along with state-of-the-art packaging design.

The centre employs around 500 people, including scientists involved in R&D and product development for the giant’s beauty brands, which include Pantene, Head & Shoulders, SK-II, and Olay.

The Olay Super Serum was just one success story to come out of the innovation centre, which marked its 10th anniversary last year.

Major companies in Singapore such as Visa, Siemens, and ABB also have their own innovation centres, as the Republic is pushing innovation to the forefront and building an ecosystem to support it. Companies ranging from multinational firms to startups are choosing Singapore to create, test, and export their innovative solutions to Asia and beyond.