Green Economy Index

For the first time since the report’s first iteration in 2020, it ranked the decarbonisation progress of the 10 Southeast Asian countries by assessing metrics such as targets set, regulatory framework, net zero roadmaps and emission levels.

Vietnam had made the biggest progress, in 2023, with its overall score going up by five points to 38. Setting a national net zero roadmap was the biggest contribution to its improved scoring.

Singapore’s score improved by four points to 55. The city-state was top of the index overall.

Malaysia came in second at 43 points, with Indonesia closely behind at 41 points.

As a whole, the region has made progress with more countries establishing roadmaps and companies setting net zero targets, according to the report. Almost all countries are experiencing a steady reduction in deforestation.

But solar and wind energy generation capacity still remains low at four per cent and is not increasing fast enough.

While there is significant progress in defining what needs to be done, the “how” is still unclear due to insufficient regulations and incentives to facilitate the implementation of plans.

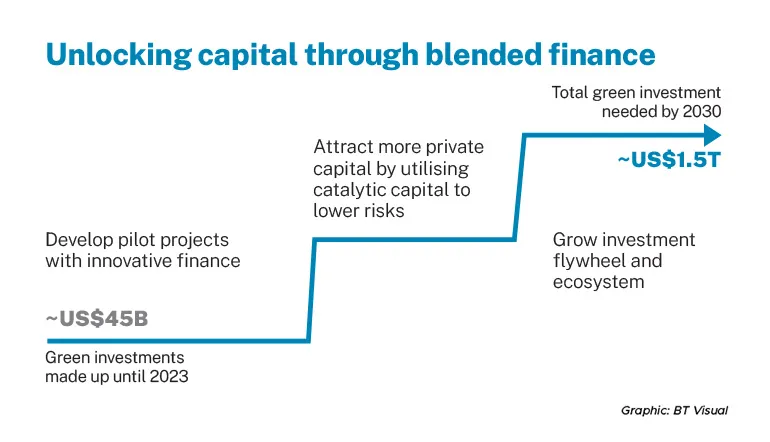

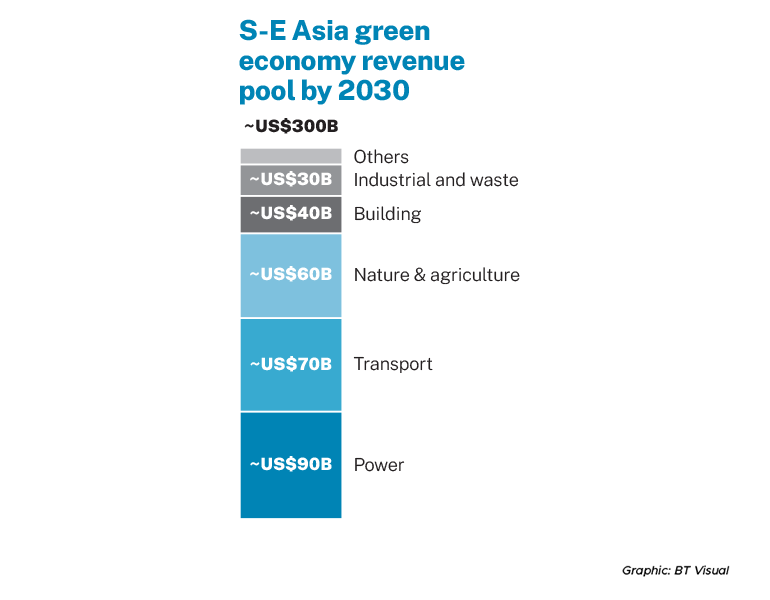

Given the lack of time to deliver its 2030 net zero commitments, the report highlighted the urgency for Southeast Asia to seize the opportunities arising out of the green economy transition.

The first few steps are already known and achievable, as no new technologies or solutions are required for Southeast Asia to decarbonise since it is still at the early stages of the energy transition.

Southeast Asia could also emerge as the centre for green exports, markets and investments, amid geopolitical tensions between the United States, the European Union, and China as each power bloc seeks to influence the pace of decarbonisation.

Source: The Business Times © SPH Media Limited. Permission required for reproduction.