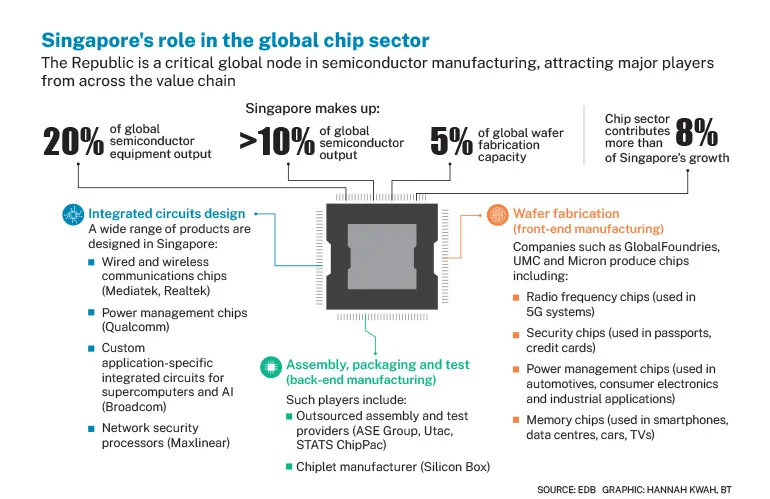

The global artificial intelligence (AI) boom is spurring some countries to vie for dominance in making leading-edge microchips – but not Singapore.

The Republic’s focus on “mature-node chips” – used in appliances, cars and industrial equipment – means its semiconductor ecosystem may have limited exposure to the AI boom, said Maybank economist Brian Lee.

Yet industry watchers do not see this as a concern, as the market for mature-node chips is much larger than that for leading-edge ones.

The chips that Singapore makes are for the mass market, said Ang Wee Seng, executive director of the Singapore Semiconductor Industry Association (SSIA).

No appetite for AI chips

AI chips are made to provide high computing power and responsive speed, said Tilly Zhang, a China technology analyst from Gavekal Research.

In contrast to mature-node chips that use so-called “process node” technology of 28 nanometres (nm) or more, cutting-edge AI chips have process nodes of 7 nm and smaller, and thus require specialised production methods. Current research focuses on developing 2 to 3 nm chips.

“That’s something that Singapore will not produce because first and foremost we don’t have the EUV (extreme ultraviolet) lithography in our fabs here – none of them have that technology,” said Ang, referring to the manufacturing technology for these smaller chips.