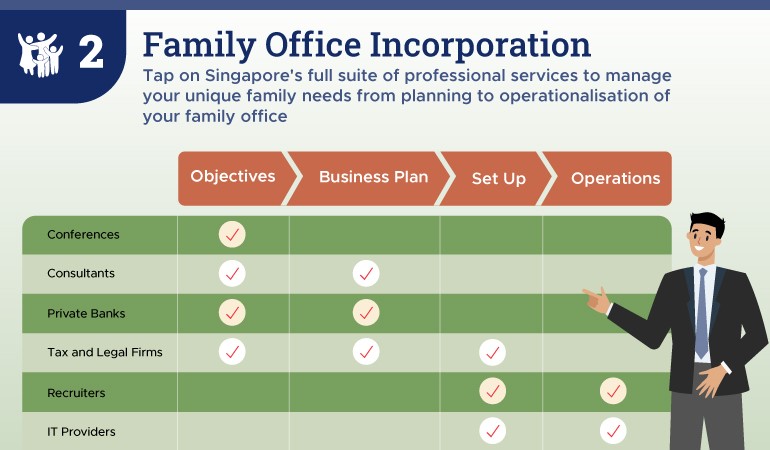

Both financial and professional services firms have strong connections in the region, and are equipped to provide advice on the structuring of acquisitions, investments, and taxation of assets across jurisdictions. This offers family principals support from the early stages of setting up a family office, to running an established one.

Investing in the family office talent pool

Continuous efforts have also been made to enhance the family office capabilities of professionals in Singapore. For example, the Monetary Authority Singapore (MAS), together with the Institute of Banking and Finance launched the Family Office Advisor Skills Map, which serves as a guide to deepen family office specialist skillsets.

Global association for family office advisors, Society of Trust and Estate Practitioners (STEP) pro-vides a platform for professionals to connect on global issues contextualised for family offices. In 2020, the Wealth Management Institute (WMI) – a centre for wealth and asset management educa-tion and research – started the first Certification Programme for Family Office Advisors.

“We carefully curate each cohort so that there is a diverse mix of participants from across the family office ecosystem, from family office professionals, wealth managers, asset managers, lawyers to tax consultants and more,” says Ms Foo Mee Har, CEO of WMI.

This has two advantages: “Participants can learn from different points of view and develop a close network with alumni who can continue to draw on each other’s expertise in the future.”

Plans are also in the pipeline for the WMI to support the growth of family offices in Singapore with more programmes covering environmental, social and corporate governance (ESG), philanthropy, and venture investing in the future.

Having attended WMI’s flagship Certificate for Family Office Advisors programme, Mr Adrian Teo, managing director and ASEAN market head, Bank of Singapore, shares that the syllabus stretches beyond the technical aspects to give advisors an in-depth understanding of family dynamics, gov-ernance and conflict resolution.

Even after his 20 years of experience in family office structuring, and intergenerational wealth trans-fer management for clients across South East Asia, he found there were insights to be gained.

“It gave us (participants) a different dimension to think about when advising families and motivated us to consider what is most important or fundamental to the family. Ultimately, families don’t just care about the money, but also about the relationships between family members,” he explains.

Banking on family needs

Echoing his sentiments, Ms Choong notes that the COVID-19 pandemic has highlighted “the im-portance and urgency of succession planning and family governance to ensure a smooth transition to the next generations in business operations and wealth transfer.”

Now, more than ever before, there is a strong need to develop a family office structure that can meet the needs of both the head of the family and successive generations.

To achieve this, WMI educates families themselves through its Leading Asian Families programme, an initiative designed to allow families to learn from each other.

“Our programme provides a space for family principals and family members to come together and share their experiences as they learn more about best practices in family office set-up and opera-tions,” Ms Foo explains.

She adds that as the family office sector continues to grow, family office principals, professionals and advisors have also recognized a growing need for community building, collaboration and peer learn-ing. To meet these needs, WMI recently launched the Global-Asia Family Office Circle in partnership with the industry and supported by EDB and MAS.

“The GFO Circle at WMI will be a trusted environment for the family office community to come together, share knowledge and gain access to cutting-edge insights,” notes Ms Foo.

“As the sector develops, it is critical to also have a support network and community, so that it can continue to thrive and galvanise purposeful wealth.”

Rebalancing for family matters

To better support the growing needs of families in Singapore, Economic Development Board (EDB) and MAS formed the Family Office Development Team (FODT) in 2019. The strategic partnership is aimed at enhancing the operating environment for family offices, improving the capabilities of the fi-nancial and professional services sectors, and building a connected family office community.

In 2020, Singapore also launched the Variable Capital Companies (VCC) framework, a move lauded as a game-changer for fund management and domiciliation — and one that can provide families with more options to customise their family office operations to their needs.

Although it is currently extended for licensed fund managers, there are discussions on how this could be made available to single family offices in the future. These changes demonstrate how “regulators are willing to consider and incorporate industry feedback to ensure our family office ecosystem re-mains cutting-edge,” says Ms Choong.

For family offices, what this means is that being based in Singapore offers more than stability, in-vestment opportunities and expertise. They can also have the confidence that the existing ecosys-tem and community will constantly evolve and remain robust to serve them well into the future.