For example, in order for the companies to improve their technology, they would sometimes need to work with research institutes.

Singapore’s plan provides public funding of R&D at research institutes. The aim is to build capabilities in the relevant technologies and support its adoption by the industries.

“The Index’s framework helps companies to decide and prioritise on the technology to invest in. Thereafter, companies can look towards public R&D infrastructure to develop the technologies. For example, a few months back, A*STAR (Agency for Science, Technology and Research) launched a model factory for advanced manufacturing at SIMTech,” Mr. Lim explained. “The model factory simulates production environments where companies can experiment and learn new manufacturing technologies. With the help of public sector researchers, companies can test these technologies before deploying them in their factories.”

The Industry Transformation Maps (ITM) provide another example of how the Index fits in with other initiatives. The Government is developing ITMs for 23 industries grouped into 6 broad clusters: Manufacturing, Built environment, Trade & connectivity, Essential Domestic Services, Modern services and Lifestyle.

An essential part of the ITM is skills training for the workforce, which is covered by the Index’s pillar on ‘Talent Readiness’.

Mr. Lim said, “The training programmes that we will put in place to support companies, will also be supporting the whole movement to enhance our advanced manufacturing capabilities.”

Implementation plans

During the launch event, which featured speeches and an industry panel discussion; the speakers stressed repeatedly that companies have to leave their comfort zones and take a long, hard, objective look at where they stand on all the parameters. It is not about obtaining a high score or the highest score among peers. The Index aims to provide a baseline for manufacturers to gauge where they stand, where they need to be and how they can reach there.

To aid companies in using the Index, EDB and TÜV SÜD will be conducting a series of four workshops in the next few months.

EDB will also work with the various trade associations and chambers in Singapore to get the information and the knowledge out to all the companies. EDB is also considering the accreditation of some companies and experts so that they can help companies use the Index and do the analysis. This could be announced as early as next year.

Balancing breadth of coverage with need for specificity

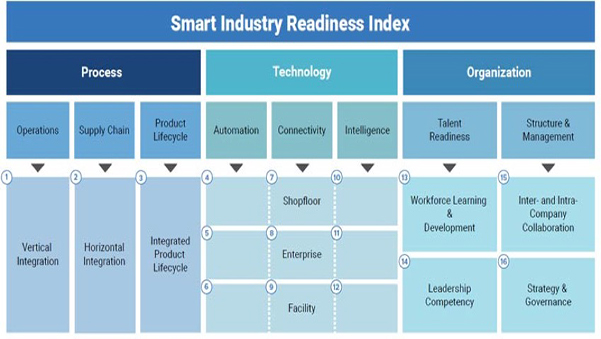

The Index is applicable for all manufacturers across all sectors because it addresses the fundamentals of each organisation: technology, process and organisation. It might sound generic but companies have to prioritise their future course of action and that will compel them to think in terms of specific needs. Where the different manufacturers and different industries prioritise depends on where the industry is heading. That is the customisation part.

“If you think about the ITMs, they are tailor-made to an industry such as electronics, energy and chemicals and so on. Each industry will have different growth drivers, which will influence the area of focus for Industry 4.0 implementation. The Index however, provides a common framework for everyone to engage about Industry 4.0,” said Mr. Lim.

Mr. Lim gave an example, “You have to make an assessment and decide what is your immediate focus. Is it going to be training the workforce for Industry 4.0? If it’s training, what is the type of training your company requires? The demands of the workforce in electronics will differ from that in energy and chemicals, and therefore the nature of training will be very different.”

EDB will support the companies to ensure that the Index does not just remain an assessment tool. Assessment is just one part of the journey. After assessment, the companies have to decide what to do next. Then they can come back and use the tool to help track if they have made improvements and obtain guidance on the next steps.

We asked Mr. Lim if he expects the Index to be modified going forward. He replied that it is fixed for now, while adding, “If a few years later, we get feedback that things have changed, then we may have to amend the Index. It really depends as technology doesn’t stay still. It keeps moving. So, I wouldn’t discount that maybe a few years down the road, we may have to refine the Index. For now, our focus is on scaling the use of the Index.”