For instance, in May 2023, Analog Devices – which provides chip designs and innovative solutions for the industry – launched a new R&D facility in Singapore located within the Kallang Industrial Park.

Besides UMC and GF, Singapore has three other foundry companies – Vanguard International Semiconductor (VIS), which counts Taiwan’s renowned chipmaker TSMC as a major shareholder; Systems on Silicon Manufacturing Company (SSMC) – a joint venture between TSMC and the Netherlands’ NXP Semiconductors; and STMicroelectronics of France.

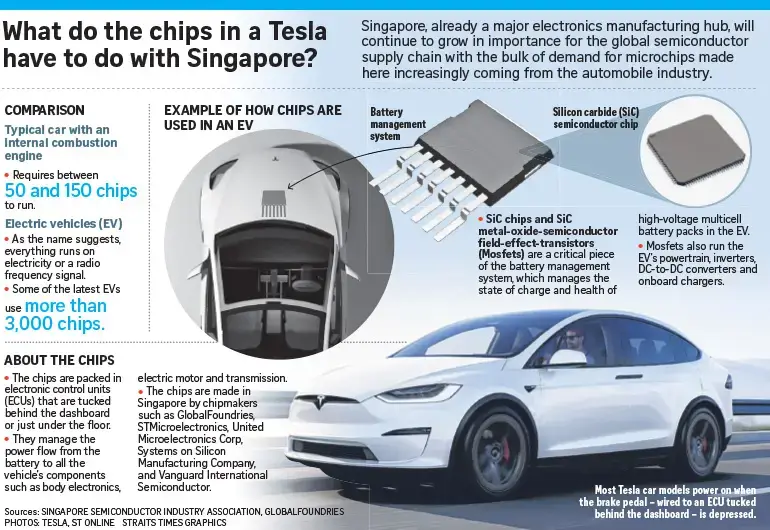

Micron Technology, for whom Singapore is the biggest manufacturing site outside of the US, makes data storage and memory chips that are also used in various automotive applications including advanced driver-assistance systems (ADAS), autonomous vehicles, cloud-connected cars, and infotainment display panels.

While the semiconductor industry has been suffering a glut since 2023 – following the boom in demand from late 2020 to most of 2022 – all these chipmakers have seen increasing business from the auto industry.

Mr Tan Yew Kong, senior vice-president and general manager of GF in Singapore, said: “A bulk of our Singapore business is focused on the automotive segment, which is a growing market as we see more electrification in cars.”

He said multiple GF-manufactured chips could be in a single car for battery management, sensors, safety features, in-car lighting systems, infotainment and more.

Mature node innovations

Chip designers are also producing modern technology architectures for EVs that will require new and innovative mature node chips.

Mr Daryl Wan, regional business director for the South Asia Pacific region at Analog Devices, said the company has developed a new battery management system that will boost the miles per charge an EV can deliver and maximise the batteries’ overall lifetime, and as a result, lower the cost of ownership.

He said the perception that mature node chips are somehow less advanced than small node chips is a misconception.

“There is still a lot of innovation going into larger chips which will keep them relevant and viable for years to come,” he said.

Mr Brian Tan, regional president of Applied Materials South East Asia, said his company gets the bulk of its business from foundries working on mature nodes.

“Most of the chips used in IoT, communications, automotive, power and sensor devices – or ICAPS as we call them – do not have leading-edge nodes. They are speciality chips and in terms of nodes, some of them are even larger than the 28 nm chips,” he said.

“We believe that there is going to be a growing market in this ICAP space,” he noted.

However, SSIA’s Mr Ang believes that Singapore will eventually have foundries making smaller nodes.

“We already have a number of chip research and design companies that are working on leading-edge process technologies. So, at some point, they will start to attract foundries that produce the same wafers and chips.”

Source: The Straits Times © SPH Media Limited. Permission required for reproduction.