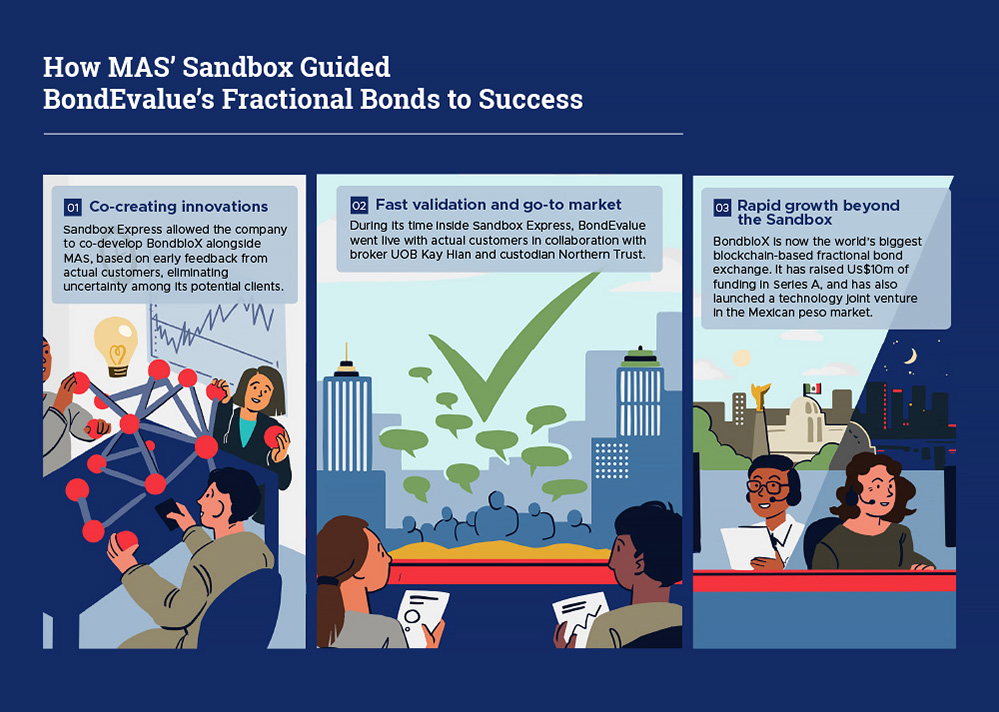

BondEvalue: Democratising Bond Markets

Founded by international banking veterans in 2016, BondEvalue’s BondbloX is the world’s first and largest fractional bond exchange. The company’s product charters and business development teams are firmly established in Singapore.

By offering everyone the ability to buy bonds in smaller denominations through transparent, distributed ledger technology, BondbloX helps people invest in one of the world’s safest asset classes — global bonds.

“Although the bond market and our exchange’s reach are global, one’s home regulator — MAS in our case — is very important,” explains Chief Executive Officer Rahul Banerjee. A strong regulator, said Banerjee, must have the right balance: being open to innovative ideas while maintaining the overall safety and soundness of the financial system.

When electronic bond trading was incipient in 2016, there were no existing frameworks for BondEvalue to work within. MAS’ Sandbox Express option allowed BondEvalue to test the scalability of BondbloX within clear boundary conditions. “Without clear laws, market innovation cannot take place,” Banerjee stresses, “new industries flourish under regulation”.

Banerjee cites the use of real money, transactions, and clients as one of the crucial and distinguishing features of MAS’ Sandbox schemes. During its Sandbox Express stint, BondEvalue was even able to connect with major financial institutions such as UOB Kay Hian and BondbloX’s current global custodians Citi and Northern Trust. “It was the predetermined testing environments within the Sandbox Express,” Banerjee elaborates, “that allowed BondEvalue to adopt a plug-and-play approach, and gave us a clear path to licensing within a shorter time frame”.